Buying a new car is exciting, but can also be daunting at the same time. There are a lot of factors involved that can inflate the cost dramatically which we will cover shortly. It is especially important to do thorough research about the car buying process if you’re a first-time buyer. After all, getting a car is one of the most expensive purchases, so it’s best to make informed decisions.

Buying a car that doesn’t fit the lifestyle

It is easy to get enticed by fast sports cars – but is it really necessary? (Such cars also have high insurance and maintenance costs). Sure, it may be nice to drive such a vehicle, but most people need an affordable and reliable car instead. A car that will get them around, whether it be commuting to work or picking kids up from school wins in the end. So before purchasing a vehicle, consider whether you’re buying it because of its horsepower and appearance or practicality and reliability.

Not shopping around

For the best possible car and finance to suit your needs, it is a must to compare various deals available. Besides, consider whether you’d like to buy through a private seller or a dealership? All of these decisions are significant that will also determine the car’s price. Also, check online reviews if purchasing from a dealership.

Overpaying on finance

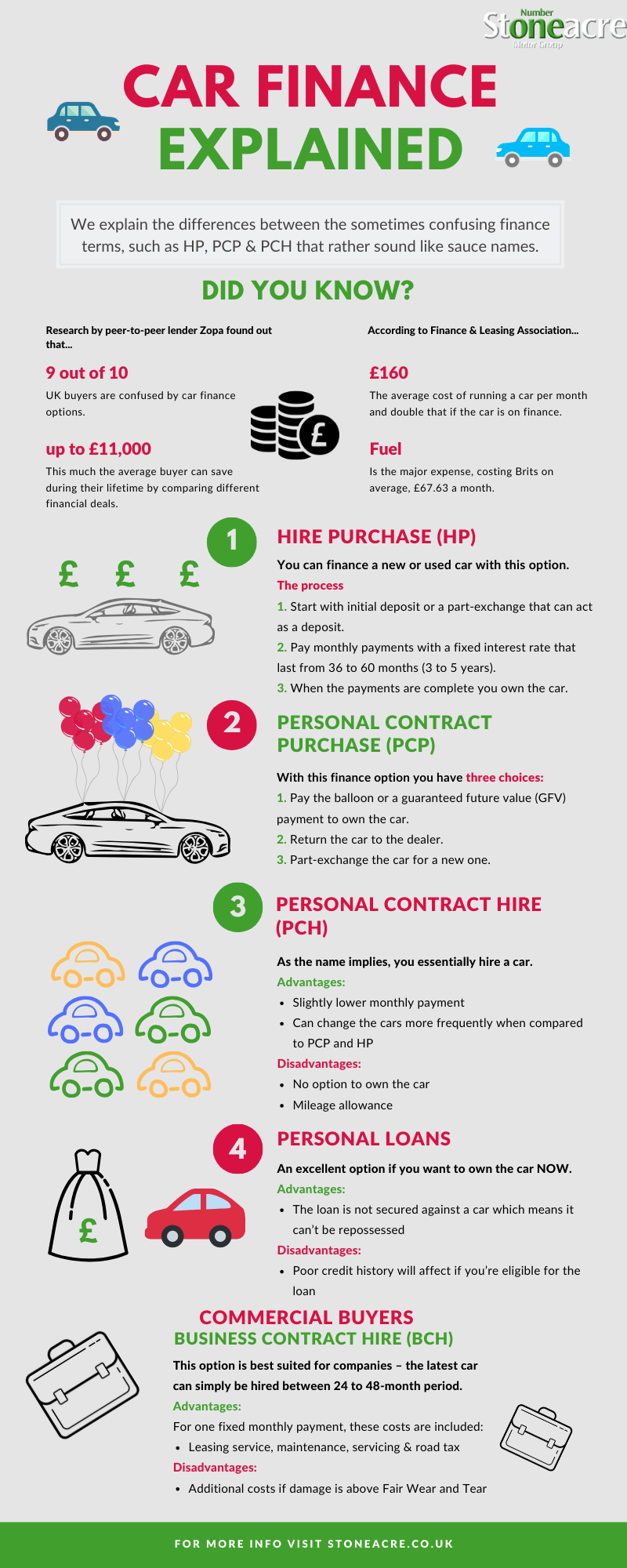

Half of the process starts when you agree to monthly payments, but the other half is even more crucial that seals the deal and determines the overall price. That part is car finance. Before agreeing to pay a certain amount each month, compare various finance options to find the best one for you. When at the dealership, discuss your options to find out if a salesperson can offer you a custom deal.

Skipping the test drive

Test-driving lets you check things, such as interior, comfort, how smooth the drive is, as well as whether there are any faults. Some dealerships also let you keep the car for 24-48h to test what the car is capable of. Pro tip: try out a variety of different roads and drive in adverse weather conditions like rain to examine the car.

Overspending the budget

If you have a limited budget, check vehicles within the price range. Don’t be tempted to spend extra just because the vehicle has all the latest features and technology. What’s more important is knowing the limit and saying no when the price is too high. Just because the monthly car payments are low, doesn’t mean the finance, fuel, road tax, and insurance will be. So add all of these costs up to find out the true price.

Don’t pressure buy

Some people feel terrified to buy a car, especially if the sales staff is pushy. However, stand the ground firmly – and know what you want beforehand. Those in an anxious and pressured state usually feel this way because they’re not prepared and don’t have enough information about the process. For others, it can be because the environment is new and feels intimidating. Either, way preparedness is key to feeling in control and confident when negotiating. If all else fails, bring someone more knowledgeable to help you through the purchasing process.

Learn the car speak

Here’s a simple question – how can you be in-control without knowing what car sellers are talking about? Learning the most common car finance terms, such as transfer fee, mileage limit, PCP, HP, equity, and others will help towards speaking the same language as the dealers and understand one another better.

Buying new instead of used

Used cars aren’t without their faults, but you can save a substantial amount of money when compared to buying new ones. If you’re looking to save money, then a used car may be the solution. Additionally, insurance can be cheaper because the value is lesser than the new car’s.

Not considering the specifications

Purchasing a car based solely on the appearance is asking for trouble, even though many can and do fall in that trap. If you lack knowledge about the technical parts, it’s best to let the mechanic inspect the car you want to purchase. The dealership or private sellers should allow it.

Not understanding the contract

Self-explanatory, but still true – understand what you’re signing up for. Make sure that the dealer didn’t include any extras, such as extended manufacturer warranty, gap insurance or other add-ons within the agreement. Best case scenario – let the legal expert read it and explain it all in simple terms about what’s going on.

As you can see, there are a lot of things that can wrong and they often do. That’s why the majority of the process should be done when researching about the type of car you’d like to have and what finance deal is the best by considering all the costs. The more prepared you are – the better. It’s cheesy, but true that knowledge is power. Did you have any regrets when buying a car? If so, share it with us in the comments down below!