If you’re a first-time buyer looking for your first home, it’s likely that you’ve already come across the government’s help to buy scheme, or you may be a part of the scheme already.

The help to buy scheme is made up of 3 main parts, including:

The help to buy ISA

The help to buy shared ownership scheme

The help to buy equity loan

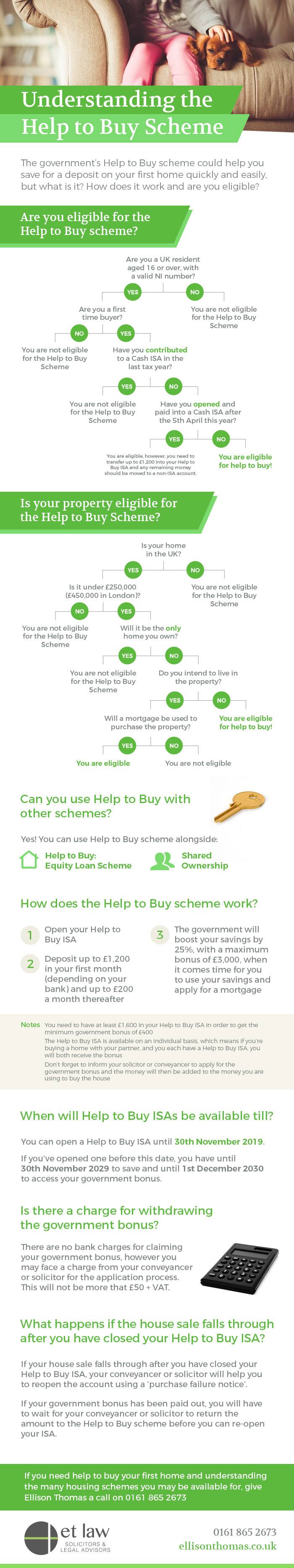

Buying your first home comes with a lot of challenges, whether it’s saving for the deposit or finding your perfect home in the first place! Despite this, the end result of owning your own home is always rewarding. That’s why I’ve teamed up with Ellison Thomas Solicitors to help you (and myself!) make sense of the Help to Buy Scheme and the different options out there to help people get on the property ladder.

Despite the fact that you only have until November 2019 to open a Help to Buy ISA and until December 2030 to access your government bonus, there are a range of other options out there to help you buy your first home. Read on to learn a little bit more about what these options are!

Help to Buy: Shared Ownership

Shared ownership gives you the option to buy a share of your home and pay rent on the remaining share, rather than paying for the entirety of your home’s purchase price.

Example:

With shared ownership, you can buy between 25% and 75% of your home’s value. Therefore, if you wanted to buy 50% of a £200,000 home, your share would be £100,000 and the housing associations share would also be worth £100,000. Your deposit would be 10% of the value of your share (£10,000), and you’d need a £95,000 mortgage to cover the rest of your share.

This is a more affordable way of buying a home as you’ll have less to pay upfront, and you have the option to buy more shares of your home in the future if you have enough money. Not only this, but you’ll also pay subsidised rent on the remainder of your home!

Help to Buy: Equity Loan

The help to buy equity loan is slightly more complicated than the help to buy ISA and shared ownership schemes.

With this option, the government can lend you up to 20% of the value of your home (new builds only). You only need a 5% cash deposit upfront and a mortgage to cover the final 75% of the value of your home.

One of the main advantages of this option is that the loan is interest-free for the first five years, so you won’t have to worry about paying interest until you’re in your 6th year of owning your home. After this point you’ll be charged 1.75% interest on the original loan value (which rises in line with inflation), therefore, if the price of your house goes up you won’t have to pay more.

Please note: This scheme is only expected to run until 2021. So now’s the time to sign up if you think this is the right option for you!

Lifetime ISA

The lifetime ISA is another viable alternative to the help to buy ISA. This allows you to save up to £4,000 in it each tax year, and the government will give you a massive 25% bonus on whatever you save, which is paid into your pot each year!

Despite this, it’s important to remember that lifetime ISAs bear more risk than help to buy ISAs as your money is invested in the stock market, so returns aren’t guaranteed.

In addition to this, the lifetime ISA is only available to those who are aged 18 to 39 so you won’t be eligible if you’re outside of this age bracket.

If you’re struggling with any aspect of the help to buy scheme, it’s important to contact your local help to buy agent, or speak to residential property solicitors such as Ellison Thomas solicitors who can help to walk you through the process and answer any questions.